The Facts About Tulsa Ok Bankruptcy Specialist Revealed

Table of ContentsThe Best Strategy To Use For Best Bankruptcy Attorney TulsaSome Ideas on Tulsa Bankruptcy Lawyer You Need To KnowTop-rated Bankruptcy Attorney Tulsa Ok - TruthsTulsa Bankruptcy Filing Assistance - An OverviewHow Affordable Bankruptcy Lawyer Tulsa can Save You Time, Stress, and Money.

The stats for the various other primary type, Phase 13, are also worse for pro se filers. Suffice it to say, speak with an attorney or 2 near you who's experienced with personal bankruptcy legislation.Several lawyers additionally use free assessments or email Q&A s. Benefit from that. (The charitable application Upsolve can assist you discover cost-free consultations, resources and lawful aid for free.) Ask if insolvency is undoubtedly the best choice for your scenario and whether they think you'll certify. Prior to you pay to submit personal bankruptcy types and acne your credit rating report for as much as one decade, check to see if you have any kind of viable alternatives like financial obligation negotiation or non-profit credit score counseling.

Ads by Cash. We might be compensated if you click this ad. Ad Since you have actually made a decision bankruptcy is certainly the best program of activity and you hopefully removed it with an attorney you'll need to get going on the documentation. Before you study all the main bankruptcy forms, you should get your very own documents in order.

The smart Trick of Tulsa Bankruptcy Legal Services That Nobody is Discussing

Later down the line, you'll actually require to confirm that by divulging all kind of information regarding your economic affairs. Right here's a basic listing of what you'll need when traveling in advance: Determining records like your motorist's permit and Social Safety card Income tax return (up to the past 4 years) Evidence of income (pay stubs, W-2s, self-employed incomes, income from possessions as well as any income from government benefits) Financial institution declarations and/or retired life account statements Proof of worth of your properties, such as car and realty evaluation.

You'll want to comprehend what type of debt you're attempting to solve.

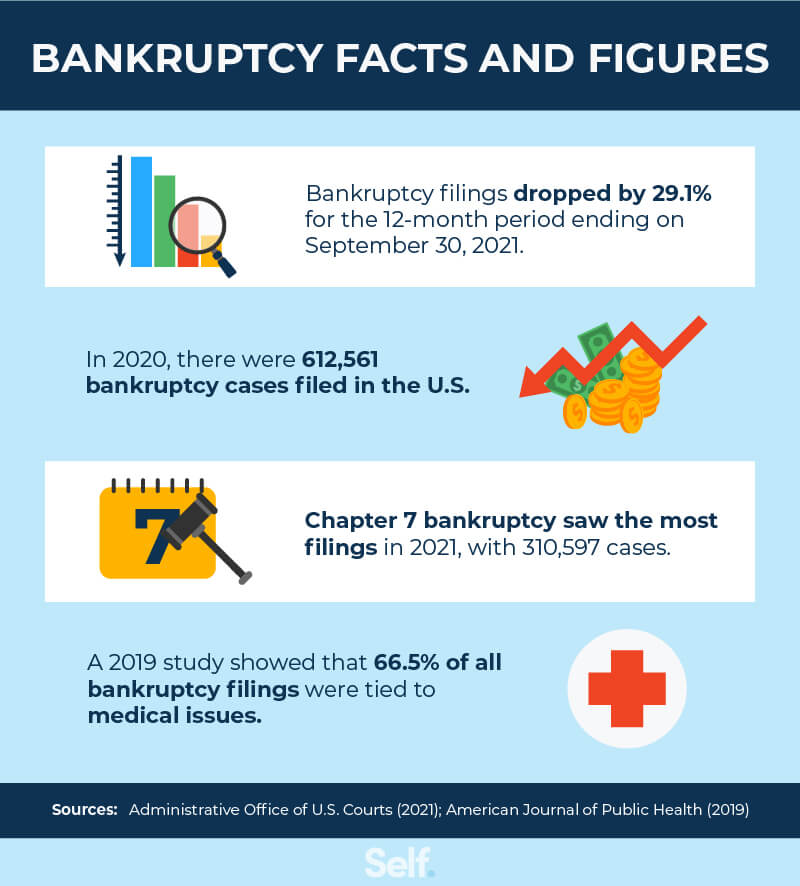

You'll want to comprehend what type of debt you're attempting to solve.If your revenue is too high, you have an additional choice: Phase 13. This choice takes longer to fix your financial obligations due to the fact that it requires a long-lasting payment strategy typically 3 to 5 years prior to some of your continuing to be financial obligations are cleaned away. The filing process is also a lot extra complex than Chapter 7.

Tulsa Ok Bankruptcy Specialist for Beginners

A Chapter 7 bankruptcy remains on your credit score record for 10 years, whereas a Chapter 13 bankruptcy falls off after seven. Before you submit your personal bankruptcy kinds, you should initially complete a necessary course from a debt therapy company that has been accepted by the Division of Justice (with the significant exception of filers in Alabama or North Carolina).

The program can be completed online, face to face or over the phone. Courses usually cost in between $15 and $50. You have to complete the training course within 180 days of declaring for insolvency (bankruptcy attorney Tulsa). Make use of the Department of Justice's site to find a program. If you stay in Alabama or North Carolina, you must select and complete a course from a list of independently accepted companies in your state.

An Unbiased View of Chapter 13 Bankruptcy Lawyer Tulsa

An attorney will usually manage this for you. If you're submitting by yourself, know that there are regarding 90 various personal bankruptcy areas. Examine that you're submitting with the proper one based on where you live. If your copyright has actually relocated within 180 days of loading, you should file in the district where you lived the greater section of that 180-day period.

The Buzz on Chapter 7 Vs Chapter 13 Bankruptcy

If you're at risk of repossession and have actually tired all other financial-relief alternatives, after that declaring Phase 13 may delay the repossession and assist in saving additional reading your home. Ultimately, you will still require the earnings to proceed making future mortgage payments, in addition to settling any late payments throughout your repayment strategy.

The audit could delay any debt relief by several weeks. That you made it this far in the procedure is a respectable indicator at least some of your financial debts are eligible for discharge.

Comments on “The Buzz on Tulsa Debt Relief Attorney”